how to lower property taxes in california

Ask the tax man what steps you need to take in order to appeal your current bill. Postpone any renovations until after the assessment because every home improvement can increase your propertys value Analyze your tax bill and report inaccuracies to the assessor.

New Prop 19 Property Tax Measure Can Save You Money Orange County Register

By the time you are already paying a certain amount its largely too late.

. As a result you might end up paying more than you can handle. If you believe your home is assessed at a higher value than it should be you can file an appeal with. Assessed value is often.

This video covers how property tax is calculated and how you can pay a lower overall property tax. There are a myriad of others. If you have high taxes there are several ways in which.

Brought to you by Sapling Steps to Appeal Your California Property Tax Begin your appeal process by filing an Assessment Appeal Application Form BOE-305-AH which. The following are 10 ways to lower taxes that are frequently overlooked by even the most sophisticated California commercial property owner. Contact your local tax office.

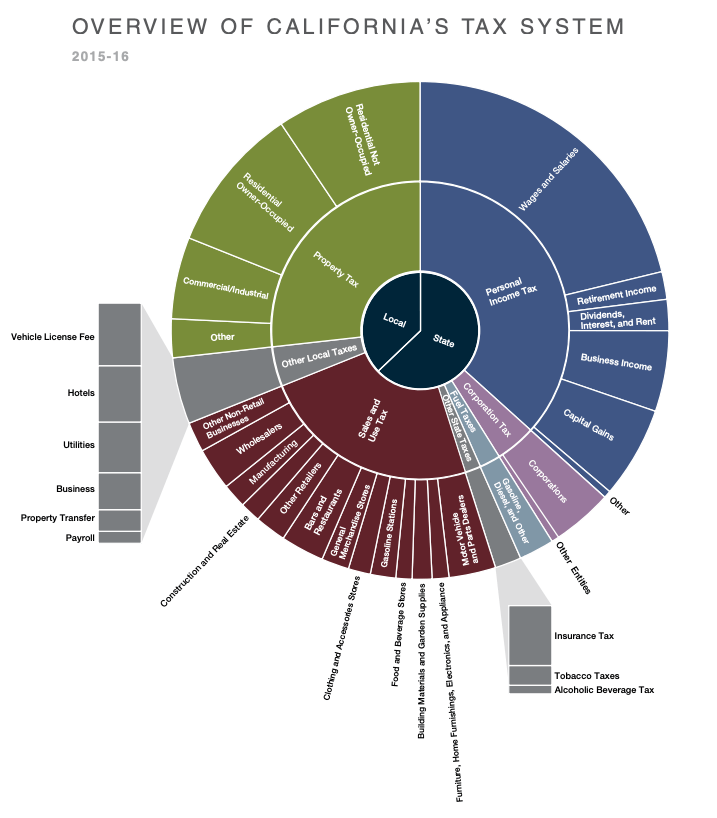

It does not reduce the amount of taxes owed to the county In California property taxes are collected at the county level. The median property tax in California is 283900 per year for a home worth the median value of 38420000. The BOE acts in an oversight capacity to ensure compliance by county assessors with property tax laws regulations and assessment issues.

How can I lower my property taxes in California. Counties in California collect an average of 074 of a. Homeowners exemption Senior citizens exemption Veterans exemption.

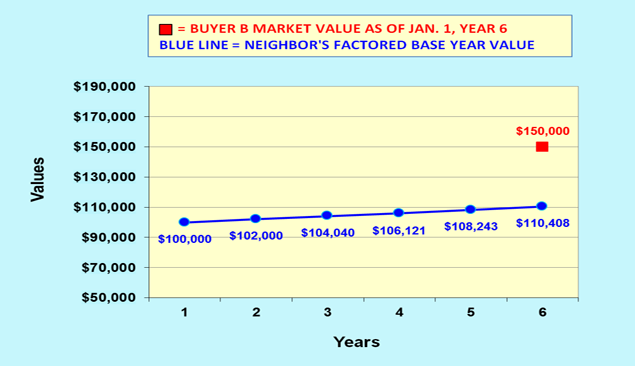

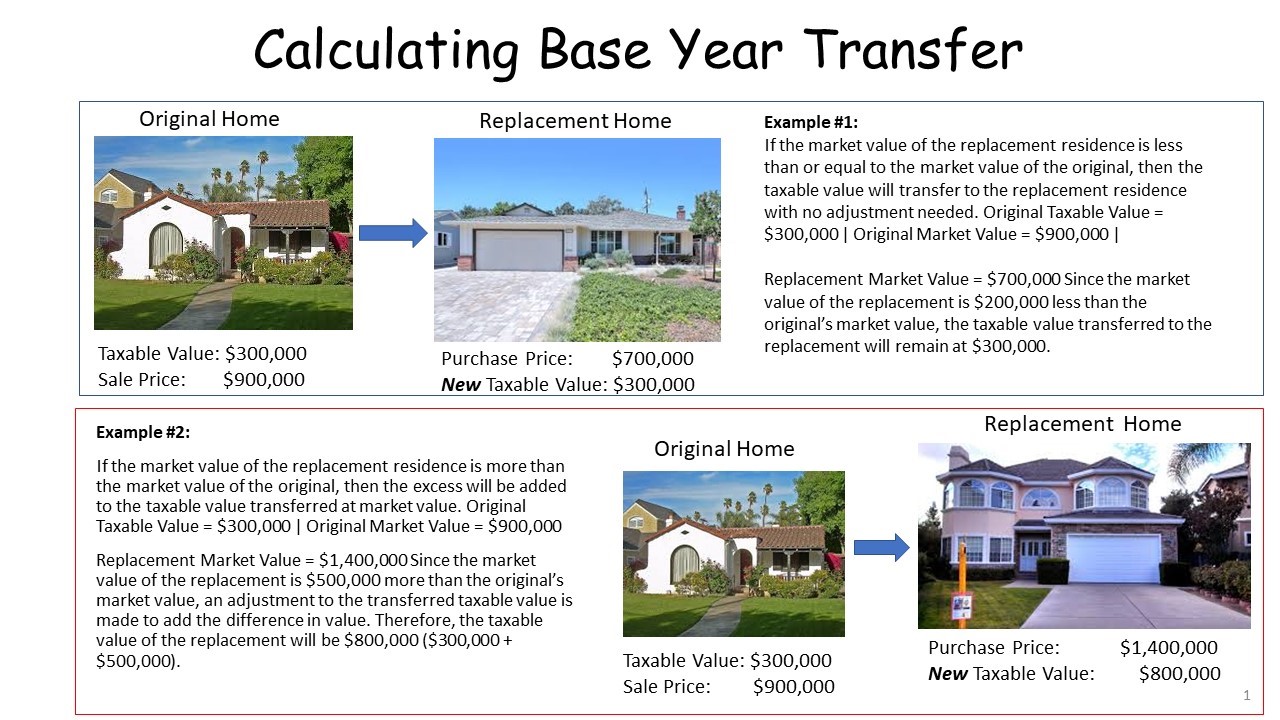

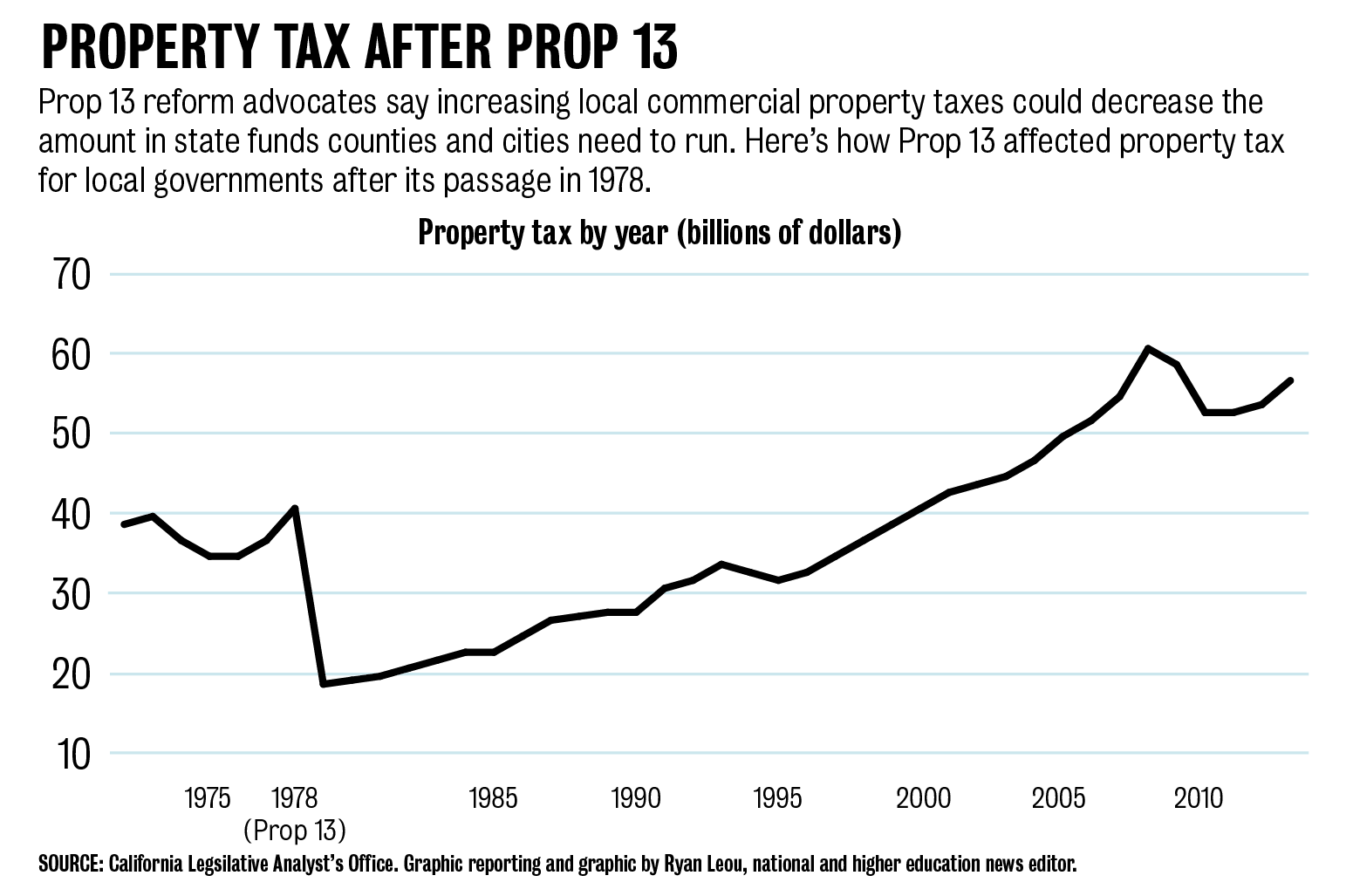

The best way to reduce property taxes in California is to apply for one of the following property tax exemptions. There are two main methods per laws known as Proposition 13 Proposition 58 and Proposition 19. This means if a parent bought a property in the 1970s and has a tax basis that is.

ASSESSMENT INFORMATION Christina Wynn Assessor 3636 AMERICAN RIVER DRIVE SUITE 200 SACRAMENTO CA 95864-5952. By Proposition 6090 you can buy or construct a new home of equal or. If you are at least 55 and residing in California you can save a substantial amount of money on your property taxes.

California offers several property tax exemptions that can significantly reduce your annual property tax bill. The available exemptions are. Taxes in California are high from the sales tax to the property tax.

Applicants must file claims annually with the. As a result one of the most effective strategies to lower your total tax burden is to lower the assessed value of your homein. How Do I Reduce My Property Taxes.

One way to reduce your property taxes is to appeal your assessment. Look for local and state exemptions and if all else fails file a tax appeal to lower your. To perform the oversight.

Homeowners property tax exemption Senior. The table below shows effective property tax rates as well as median annual property tax payments and median home values for each county in California. Up to 25 cash back How can you reduce your California property tax burden.

Here are a few steps you can take to cut your property taxes.

California S White Homeowners Get Bigger Prop 13 Tax Breaks Calmatters

Tangible Personal Property State Tangible Personal Property Taxes

How Much Tax Do You Pay When You Sell Your House In California Property Escape

U S Cities With The Highest Property Taxes

At What Age Do You Stop Paying Property Tax In California Best Tax Service

Writing A Property Tax Assessment Appeal Letter W Examples

U S Cities With The Highest Property Taxes

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

How Will The New Tax Bill Affect Housing Costs In The Eastern Sierra Inyo County Mono County Real Estate Homes For Sale In Bishop Owens Valley Big Pine And

Op Ed Californians Should Wise Up About Our Stupid Tax Code Los Angeles Times

Ucsa Campaign Aims To Reform Prop 13 To Increase Uc Funding Daily Bruin

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

How Do State And Local Property Taxes Work Tax Policy Center